Can I Get Debt Collectors Off My Back?

May 8, 2019Debt collectors can be ruthless when it comes to getting the money they are owed. Their phone calls can start early in the morning and continue through nine o’clock at night. They can call your home and your place of business. These debt collection calls can cause massive amounts of stress and annoyance.

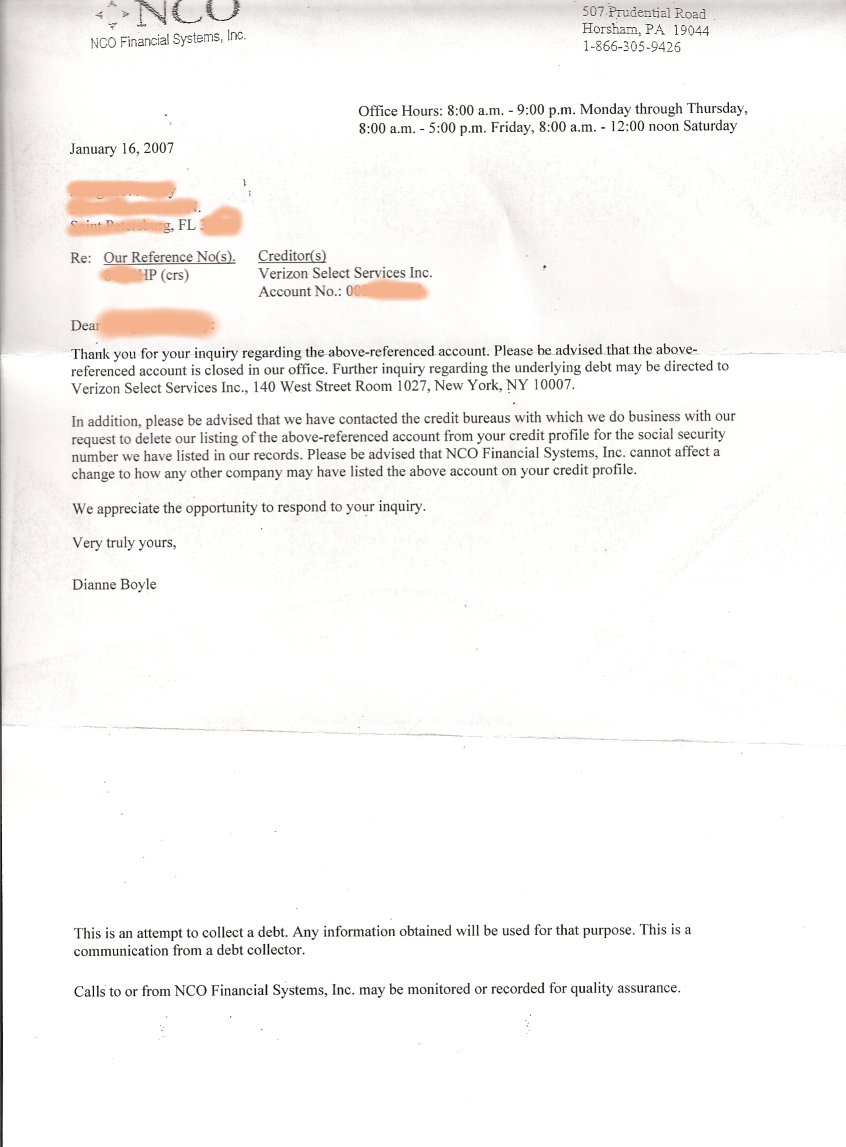

When you are having trouble paying your bills, debt collection companies uk will start contacting you demanding payment. Cease and desist instructions can be used to ward off debt collectors to a point, but only really to prevent stalking. Sending the letter does not mean you no longer have to pay the bill, it only stops the collection agency from calling.

Credit card cases are typically what I call “document” cases. The credit card company, or collection agency, needs documents to prevail in court. Most often, they need a cardmember agreement, terms and conditions, monthly account statements, and if the debt was sold, a copy of the Assignment. (Assignment is a contract between original creditor and purchasing debt collection company). When a debt is sold, at least when it is sold for pennies on the dollar, the documents often are not sold as part of the deal. Most of you are thinking, “That can’t be true, can it”? It is the truth. Think about the price of the debt. A collection agency pays pennies on the dollar, how much can they actually get? Often, its just a name, address, phone number, account number, balance, and not much else.

It is highly suggested that you ask for professional help once you are caught up in such situation. You can always hire an agent from a debt negotiation company who will assist you in the process of settlement. You can be assured of relief because these professionals will talk to your creditors on your behalf. Get rid of those harassing phone calls that ruin your day.

Now what do you do with the check? Probably one of two things: either you deposit it into your checking account, or you take it to a merchant for instance, a car dealer. In either case, the check, when deposited goes directly to the bookkeeping department where the numbers are transferred from the check and are added to your account as a bookkeeping entry. Once this entry is made a bank will say that its deposits have increased.

They commonly send you a response, stating you signed a contract and you must pay it, or offering you payment counseling, or even reducing the amount you owe and telling you to pay the discounted amount. They often claim to have the proper authority, but they never provide any proof of any authority. If they have the authority to lend their credit, WHY CAN’T THEY PROVE IT?

The most important thing to focus on is getting your cards under their limit. This will save you in the long run. Remember how to repair credit, and you will have your score back to where it should be.